Overview

The Tax Cuts and Jobs Act of 2017 created a new initiative known as Opportunity Zones that utilize tax incentives to draw long-term investment to communities with high unemployment and poverty rates.

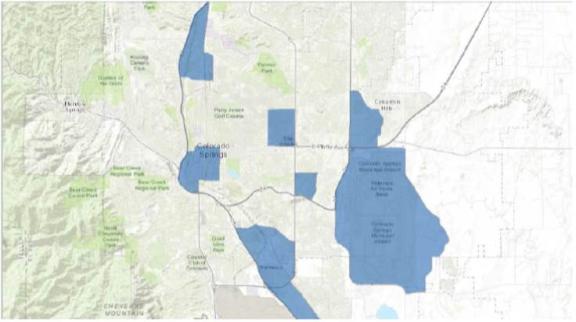

In the Pikes Peak Region, a total of 8 Opportunity Zones have been designated by the U.S. Department of Treasury.

Interested investors will be able to defer their capital gains taxes by investing them in Opportunity Funds that provide needed long-term investments in our region’s Opportunity Zones to promote economic vitality.

Possible investment opportunities could include:

- Real estate development and significant rehabilitation in Opportunity Zones

- Opening new businesses and expansions of businesses already within Opportunity Zones

- Investing in startup businesses that have the potential for rapid increases in scale

- Workforce and affordable housing projects

Opportunity Funds can be established as a partnership or corporation to invest in eligible opportunities in an Opportunity Zone and are required to meet U.S. Department of Treasury guidelines.

The state has launched a Colorado investment database to help investors find opportunities and for projects and entrepreneurs to connect to capital for growth across the state.

How to Establish a Qualified Opportunity Fund

- Novogradac- Opportunity Zones: Establishing and Maintaining Compliance

- NES Financial overview of using an LLC to form a QOF

- Podcast with how-to on forming a QOF

- Milken Institute OZ playbook

- Deep Dive: Final Opportunity Zone Regulations Explained

Colorado Springs Opportunity Zones Prospectus

Economic development stakeholders in the region held community meetings within the 8 Opportunity Zones, identifying assets and project opportunities seeking Opportunity Zone funding, and created a Regional Investment Prospectus. These efforts were led by the Colorado Springs Chamber & EDC and informed by local economic development organizations, stakeholders, investors, and interested individuals.

Collaborators included the City of Colorado Springs Economic Development Division, El Paso County, the City of Fountain, the Office of Economic Development and International Trade (OEDIT), the Colorado Springs Downtown Partnership, local Economic Development partners, organizations, stakeholders, and interested individuals.

Background Information

Tax Cuts and Jobs Act 2017 Framework

The 2017 Tax Cuts and Jobs Act legislation created the following three main components of Opportunity Zones:

- Criteria for designating Opportunity Zones in every U.S. state and territory

- Establishment of a new private investment vehicle called Opportunity Funds

- Provide incentives to investors to reinvest their capital gains into Opportunity Funds to provide capital for new and expanding businesses, affordable housing, infrastructure, energy, commercial development, etc. in designated Opportunity Zones.

Available Tax Incentives

The law allows for the following capital gains incentives for investment in an Opportunity Fund:

- Temporary deferral until 2026 of taxable capital gains invested into an Opportunity Fund.

- Step-up in basis for capital gains invested in a Qualified Opportunity Fund:

- Basis is increased by 10% if investment held for at least 5 years, by 2026.

- Basis increased by an additional 5% (15% total) if held for at least 7 years, by 2026.

- Permanent exclusion from taxable income of new capital gains from sale or exchange of an investment in an Opportunity Fund if investment held for at least 10 years.

How Opportunity Zones Were Established

The City of Colorado Springs worked closely with El Paso County, the City of Fountain, the Colorado Springs Chamber and EDC, and the Office of Economic Development and International Trade through an inclusive and rigorous process to nominate census tracts for Opportunity Zone status. The following are details on the criteria and timeline for Opportunity Zone designation.

- Eligible census tracts had to have at least a 20% poverty rate or a median family income of no more than 80%.

- Governors could only designate 25% of total number of low-income census tracts in the state.

- Governors had 90 days from when tax bill was signed to nominate census tracts (March 21, 2018).

- Department of Treasury had 30 days to complete certification of Opportunity Zones. Zones are now certified and locked in for 10 years. There are over 8,700 census tracts designated as Opportunity Zones across the U.S.

Contact Information

Questions or comments about Opportunity Zones can be sent to the Economic Development Division at shawna.lippert@coloradosprings.gov | 719-385-6803.

Resources

Additional information on Opportunity Zones can be found at the links below. The City of Colorado Springs and Strategic Team Partners do not specifically endorse or confirm any resources, businesses, organizations, or individuals. If you have something helpful you would like us to share, please send it to us at shawna.lippert@coloradosprings.gov | 719-385-6803.